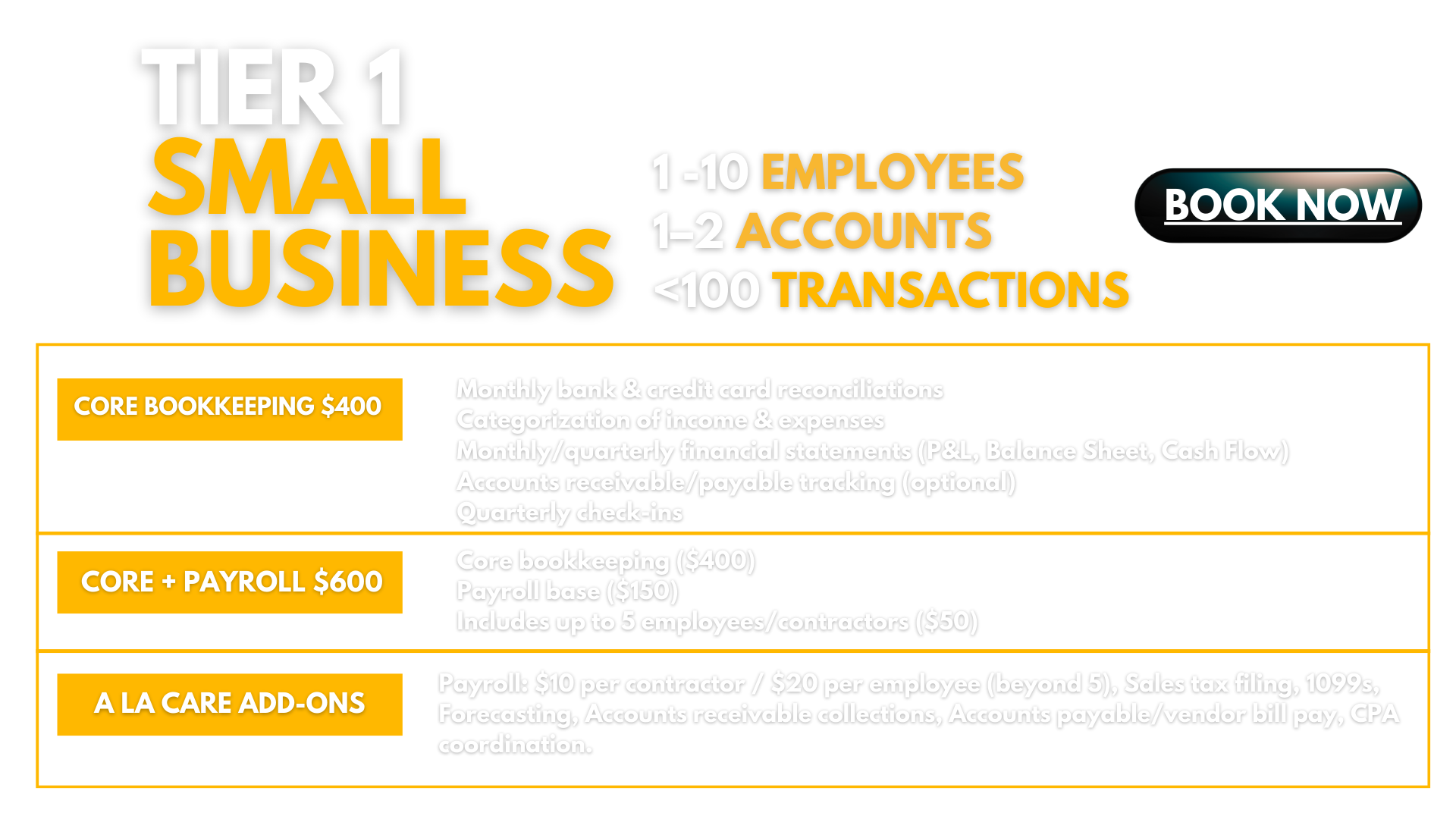

✅ Monthly bank & credit card reconciliations

✅ Categorization of income & expenses

✅ Monthly/quarterly financial statements (P&L, Balance Sheet, Cash Flow)

✅ Accounts receivable/payable tracking (optional)

✅ Quarterly check-ins

*flat monthly fee (based on 1-2 accounts & up to 100 transactions monthly)

Everything in Core Bookkeeping, plus:

✅ Payroll setup (if needed)

✅ Payroll processing (weekly, biweekly, or monthly)

✅ Payroll tax filings (federal & state)

✅ Unemployment insurance reporting

✅ Employee/contractor onboarding assistance

⚡ Sales Tax Filing → $75–$150 per filing (monthly/quarterly, depending on # of jurisdictions)

⚡ 1099 Preparation & Filing → $25–$50 per form (with a $150 minimum)

Covers data gathering, e-filing, and sending copies to contractors.

⚡ Budgeting & Forecasting Reports → $200–$500 per report (or $150–$250/month if recurring updates)

Depends on whether it’s a one-time budget build or ongoing forecasting.

⚡ Accounts Receivable Collections Support → $150–$300/month (light follow-up emails/calls), or $25–$50 per invoice chased

⚡ Accounts Payable / Vendor Bill Pay → $150–$300/month (basic scheduling + processing), or $3–$5 per bill processed

⚡ CPA Coordination for Tax Prep → $100–$250 (flat seasonal fee)

Covers gathering docs, preparing year-end reports, and liaising with CPA.

⚡Additional Reporting / Custom Dashboards → $150–$400 (depending on complexity & software)

E.g., KPI dashboards, departmental reports, Google Data Studio/Excel visuals.